IUL is a bad investment due to high fees and complex structure. Investors often experience low returns.

Considering various investment options can help you make informed decisions about your financial future. While Indexed Universal Life (IUL) insurance policies may sound appealing, they come with certain drawbacks that make them a less than ideal choice for many investors.

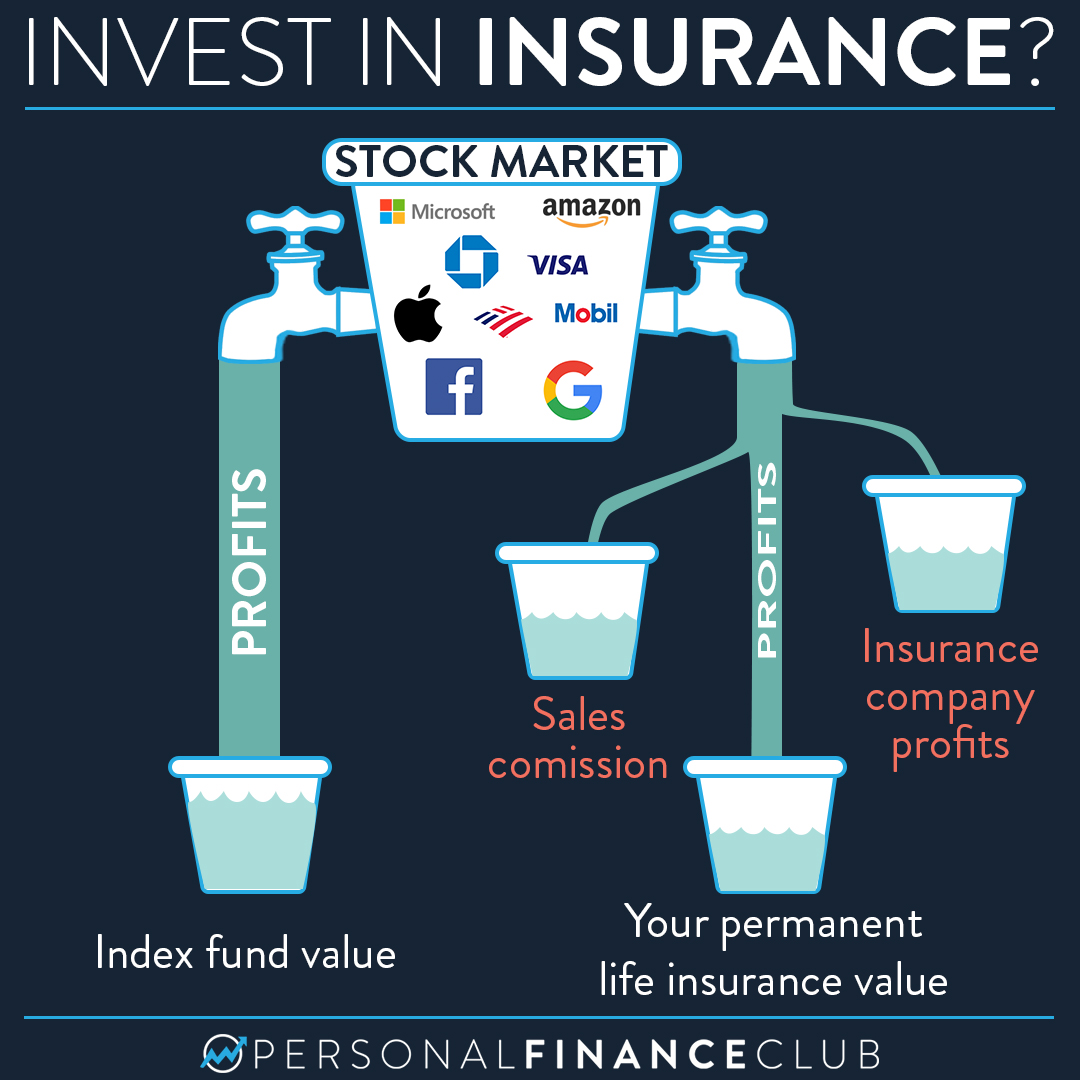

One of the main reasons why IUL is considered a bad investment is the high fees associated with these policies, which can significantly eat into your potential returns over time. Additionally, the complex structure of IUL policies can make it difficult to fully understand how your money is being invested and what kind of returns you can expect. By exploring alternative investment options, you can potentially find more transparent and cost-effective ways to grow your wealth.

The Iul Investment Controversy

The IUL investment controversy has sparked heated debates among financial experts and investors. While some tout it as a reliable way to build wealth, others caution against its potential drawbacks. Understanding the myths, public perception, and the reality surrounding IUL investments is crucial for making informed financial decisions.

Myths Vs. Facts

Myth: IUL guarantees high returns regardless of market conditions. Fact: IUL returns are tied to market performance, subjecting it to volatility and potential losses. Myth: IUL offers the best of both worlds – the potential for high returns and downside protection. Fact: IUL’s caps and participation rates can limit returns, while the downside protection may be less effective than perceived.

Public Perception And Reality

The public perceives IUL as a risk-free investment with lucrative returns, but the reality is far more complex. While marketing often emphasizes the benefits, the fine print reveals potential downsides that may not align with investors’ expectations.

Decoding Indexed Universal Life Insurance

How Iul Policies Work

Indexed Universal Life Insurance (IUL) policies are a type of permanent life insurance that accumulates cash value based on the performance of a stock market index, such as the S&P 500. Premium payments made by the policyholder are allocated to a cash value account, which grows over time based on the index’s performance. The policyholder has the potential to benefit from market gains, but is protected from market losses through a guaranteed minimum interest rate.

Key Components Of Iul

The key components of an Indexed Universal Life Insurance policy include the cap rate, participation rate, and floor rate. The cap rate sets the maximum interest rate that can be credited to the cash value, while the participation rate determines the percentage of the index’s gain that is credited to the policy. Additionally, the floor rate acts as a safety net, ensuring that the policy’s cash value does not decrease, even if the index performs poorly.

The Downsides Of Iul Policies

Indexed Universal Life (IUL) policies have been touted as a great investment vehicle for those looking to secure their financial future. However, it’s important to be aware of the downsides of IUL policies before investing your money. In this article, we’ll take a closer look at the cost complexity and caps on returns associated with IUL policies.

Cost Complexity

One of the main downsides of IUL policies is their cost complexity. These policies are not easy to understand, and the fees associated with them can be confusing. IUL policies often come with multiple layers of fees, including insurance costs, administrative fees, and investment fees. These fees can eat away at your returns and make it difficult to determine the true cost of your policy. Additionally, IUL policies often have complex rules around withdrawals, loans, and surrender charges. These rules can be difficult to understand and may limit your ability to access your money when you need it.

Caps On Returns

Another downside of IUL policies is the caps on returns. IUL policies are tied to a specific index, such as the S&P 500, and the returns on your policy are capped at a certain percentage. This means that if the index performs well, you may not see the full benefit of that performance. Furthermore, IUL policies often come with a participation rate, which determines how much of the index’s gains you will receive. For example, if the participation rate is 80%, and the index gains 10%, your policy will only receive an 8% return.

This can be frustrating for investors who want to fully participate in the market’s gains. While IUL policies may seem like a good investment on the surface, it’s important to be aware of their downsides before committing your money. The cost complexity and caps on returns associated with these policies can make them a bad investment choice for many people.

Credit: www.personalfinanceclub.com

Hidden Fees And Charges

Hidden fees and charges can quickly eat away at the returns of an IUL policy, making it a bad investment. These fees may include policy administration charges, premium loads, and surrender charges, among others. It’s important to fully understand these charges before investing in an IUL policy.

The Impact Of Fees Over Time

High fees in IUL can significantly erode your investment over time.

Understanding Surrender Charges

Surrender charges lock you in, making it costly to exit early. Hidden fees and charges in an IUL can eat away at your investment. These fees may not be obvious at first glance, but they can have a substantial impact in the long run.

The Impact Of Fees Over Time

High fees in IUL can significantly erode your investment over time.

Understanding Surrender Charges

Surrender charges lock you in, making it costly to exit early.

Interest Crediting Methods Explained

Understanding the interest crediting methods of Indexed Universal Life (IUL) policies reveals why it can be a risky investment. The complex structure and lack of guaranteed returns make IUL a less favorable option for long-term financial growth. Investors should carefully weigh the risks before committing to an IUL policy.

When it comes to investing in Indexed Universal Life (IUL), many people get lured by the promise of high returns with no risk. However, the truth is far from it. IUL is a complex financial product, and understanding its interest crediting methods is crucial to know why it is a bad investment. In this article, we will explain the two most common interest crediting methods used in IULs: Participation Rates and Spread/Margin.

Participation Rates And Their Impact

Participation rates are one of the essential components of an IUL policy. They determine how much of the index’s gains the policyholder will receive. The participation rate is a percentage that is less than 100%, which means the policyholder will not receive the full benefit of the index. For example, if the participation rate is 80%, and the index gains 10%, the policyholder will receive only 8% (80% of 10%) as interest. The problem with participation rates is that they are not fixed and can change over time. Insurance companies can adjust the participation rates based on their financial performance, which means the policyholder can receive less interest than expected. Moreover, insurance companies can set a cap on the maximum amount of interest that the policyholder can earn, further limiting the returns.

Spread/margin And How It Affects Returns

The spread/margin is another critical factor that affects the returns of an IUL policy. It is the difference between the index’s return and the interest credited to the policyholder. For example, if the index gains 10%, and the insurance company sets a spread of 2%, the policyholder will receive only 8% as interest. The problem with the spread/margin is that it can change over time, just like the participation rates. Insurance companies can increase the spread, further reducing the policyholder’s returns.

Moreover, the spread/margin is not disclosed upfront, making it difficult for the policyholder to know how much interest they will receive. In conclusion, the interest crediting methods used in IUL policies can significantly impact the returns. Participation rates and spread/margin are not fixed and can change over time, making it difficult for the policyholder to predict their returns. Therefore, if you are looking for a stable and reliable investment option, IUL is not the right choice. It is better to invest in traditional investment options like stocks, bonds, and mutual funds that offer higher returns with less complexity.

The Illusion Of Market Returns

Investing in Iul (Indexed Universal Life) may seem like a good idea, but the illusion of market returns can be deceptive. The fees and charges associated with Iul can eat into returns, making it a bad investment choice.

Comparing Iul Returns To The Market

When considering investment options, it’s crucial to examine the potential returns they offer. One popular choice is Indexed Universal Life (IUL) insurance, which promises the benefits of both life insurance and investment growth. However, it’s important to understand the illusion of market returns associated with IUL.

The Risk Of Overstated Growth Projections

Investors are often enticed by the growth projections offered by IUL policies. These policies claim to provide returns that are linked to a specific market index, such as the S&P 500. However, it is essential to recognize the risk of overstated growth projections when considering IUL as an investment. While IUL policies may highlight historical market performance to project potential returns, it’s important to remember that past performance is not indicative of future results. The stock market is inherently unpredictable, and attempting to predict future returns based on past trends can be misleading.

Moreover, IUL policies often come with caps, floors, and participation rates that limit the investor’s potential gains. These factors can significantly impact the actual returns received, making it essential to carefully evaluate the fine print before committing to an IUL policy. Furthermore, it’s important to consider the fees associated with IUL policies. These fees can include administrative costs, mortality charges, and other expenses that eat into the potential returns.

The Risk Of Overstated Growth Projections

When compared to other investment options, such as low-cost index funds, the fees associated with IUL policies can significantly diminish the overall returns. Investors should also be aware of the tax implications of IUL policies. While the death benefit is generally tax-free, any gains from the cash value component of the policy may be subject to taxes. This can further reduce the actual returns received and should be carefully considered when evaluating the potential benefits of IUL as an investment. In conclusion, while IUL policies may appear to offer attractive growth potential, it’s crucial to recognize the illusion of market returns associated with these investments. The risk of overstated growth projections, coupled with fees and tax implications, can significantly impact the actual returns received. As with any investment decision, it is essential to conduct thorough research and consider all factors before committing to an IUL policy.

Iul And Retirement Planning Pitfalls

Avoid the pitfalls of using an Indexed Universal Life (IUL) insurance policy for retirement planning. IUL may seem attractive, but it often proves to be a bad investment due to high fees, complex structures, and lower returns compared to traditional retirement options.

Be cautious and explore all alternatives before committing to an IUL for your retirement savings.

The Long-term Viability Of Iul For Retirement

Indexed Universal Life (IUL) poses risks for retirement planning. Market fluctuations affect IUL performance over time. High fees associated with IUL can diminish returns.

Case Studies: When Iul Falls Short

Real-life examples illustrate IUL’s limitations. Low cash value growth can impact retirement funds. Inflexible premiums may strain retirement budgets.

Credit: www.personalfinanceclub.com

Alternatives To Iul Investments

Consider exploring alternative investment options to IUL, such as diversified index funds, real estate, or a traditional 401(k). These alternatives offer lower fees, greater transparency, and potentially higher returns, making them more attractive choices for long-term financial growth.

Traditional Life Insurance Products

Consider term life insurance for simple coverage. Whole life insurance offers guaranteed cash value growth.

Other Investment Vehicles For Long-term Growth

Explore mutual funds for diversified investment options. ETFs provide low-cost exposure to various asset classes.

Navigating Financial Decisions Wisely

When it comes to investing your hard-earned money, it’s crucial to approach the task with careful consideration and a keen eye for potential risks. One investment that has gained significant attention in recent years is Iul, or Indexed Universal Life insurance. While it may seem like an attractive option on the surface, there are several reasons why Iul can be a bad investment choice. To make informed financial decisions, it’s important to ask the right questions and seek professional advice.

Questions To Ask Before Investing

Before diving into any investment, it’s essential to ask yourself a series of questions to evaluate the suitability and potential drawbacks. Here are a few key questions to consider:

- What are the fees and expenses associated with an Iul policy?

- What is the projected rate of return compared to other investment options?

- What are the surrender charges and restrictions if I want to withdraw my money?

- How does the death benefit compare to traditional life insurance policies?

- What are the tax implications of investing in an Iul?

Asking these questions will give you a better understanding of the potential risks and benefits associated with an Iul investment.

Seeking Professional Financial Advice

When it comes to making complex financial decisions, seeking professional advice is invaluable. Consulting with a certified financial planner or investment advisor can help you navigate the intricate world of investments and provide you with personalized guidance based on your financial goals and risk tolerance. A professional can help you assess the pros and cons of an Iul investment by considering factors such as your age, income, financial obligations, and long-term objectives. They can also help you explore alternative investment options that may better align with your specific needs and priorities.

Remember, making investment decisions without professional guidance can lead to costly mistakes and missed opportunities for growth. Trusting the expertise of a financial advisor can help you make well-informed choices and minimize the chances of falling into investment traps. In conclusion, when it comes to investing wisely, it’s crucial to ask the right questions and seek professional financial advice. While Iul may appear enticing, understanding its potential drawbacks and exploring alternative investment options can save you from making a bad investment decision. Take control of your financial future by making informed choices and safeguarding your hard-earned money.

:max_bytes(150000):strip_icc()/pros-cons-indexed-universal-life-insurance.asp_v1-e119226901bc464593a496c003551ea0.png)

Credit: www.investopedia.com

Frequently Asked Questions

Faq 1: Is Investing In Iul A Wise Financial Decision?

Investing in Iul can be a risky move due to its high fees and low returns. It’s important to carefully consider your financial goals and explore other investment options that may offer better returns with lower costs.

Faq 2: What Are The Potential Drawbacks Of Investing In Iul?

While Iul offers the potential for tax-free growth, it comes with certain drawbacks. These include limited investment options, high surrender charges, and the possibility of not earning as much as you would with other investment vehicles. It’s crucial to weigh these factors before making a decision.

Faq 3: Can Iul Provide Guaranteed Income During Retirement?

While Iul can provide a source of income during retirement, it’s important to note that the amount received may vary based on market conditions and policy terms. It’s advisable to thoroughly review the policy details and consult with a financial advisor to determine if Iul aligns with your retirement income goals.

Faq 4: Are There Alternative Investment Options To Consider Instead Of Iul?

Yes, there are several alternative investment options that may be worth exploring. These include traditional retirement accounts like 401(k) plans or IRAs, diversified stock portfolios, or real estate investments. It’s recommended to diversify your investments to mitigate risk and potentially achieve higher returns.

Conclusion

Investing in IUL may not be the best choice due to its complex structure, potential for high fees, and limited growth. It’s crucial to thoroughly research and understand all aspects of this investment option before making any decisions. Consider seeking advice from a financial professional for personalized guidance.